When a surgeon guides a robotic arm during a minimally invasive procedure, or a cardiologist interprets real-time ECG data from a wearable patch, few consider the silent enabler behind the scenes: the custom medical cable assembly. Far more than simple wiring, these precision-engineered components are mission-critical interfaces that ensure signal fidelity, patient safety, and regulatory compliance. In today’s era of smart, connected, and portable medical devices, they’ve evolved from passive conduits into active design differentiators.

A Market at the Intersection of Innovation and Regulation

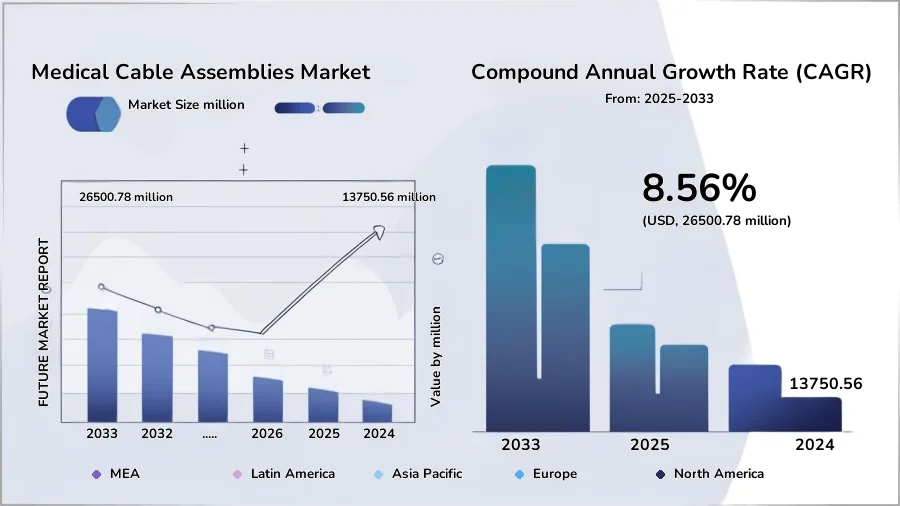

The global medical cable assemblies market is not just growing—it’s transforming. According to Future Market Report, the sector was valued at USD 13.75 billion in 2024 and is on track to reach USD 26.5 billion by 2032, expanding at a CAGR of 8.56%.[^1] Similarly, Market Research Intellect highlights surging demand across diagnostic imaging, patient monitoring, and home healthcare applications.[^2]

But numbers only tell part of the story. Underlying this growth are deeper shifts:

- Home healthcare is going mainstream: Deloitte’s 2024 Health Tech Outlook notes that 68% of chronic disease management now involves remote monitoring, requiring cables that are flexible, durable, and patient-friendly.[^3]

- Supply chains are regionalizing: Post-pandemic, McKinsey reports that over 60% of medtech OEMs are diversifying manufacturing beyond China, with Taiwan emerging as a trusted hub for high-mix, low-volume precision components.[^4]

- Regulatory scrutiny is intensifying: With the EU MDR and FDA’s focus on cybersecurity and material traceability, cable assemblies must now include full documentation—from raw material lot numbers to sterilization validation.

In this environment, “off-the-shelf” is no longer an option. Customization isn’t a luxury—it’s a necessity.

Why “Custom” Matters: From Design to Compliance

A custom medical cable assembly is a co-engineered solution, developed in close partnership between device makers and specialized manufacturers. Unlike generic cables, it integrates:

- Application-specific materials: Silicone for repeated sterilization, TPE for flexibility in wearables, antimicrobial coatings to reduce HAIs (hospital-acquired infections).

- Signal integrity engineering: Shielding against EMI/RFI in MRI suites or ICU environments where millivolt-level accuracy is life-or-death.

- Human-centered design: Lightweight, tangle-resistant, color-coded, or even kink-proof—critical for home-use devices handled by non-clinicians.

- Regulatory-ready documentation: Full ISO 13485-compliant traceability, biocompatibility testing (ISO 10993), and design history files (DHF) for FDA submissions.

This level of integration demands more than manufacturing—it requires deep domain expertise in both medical device design and global compliance frameworks.

The Rise of Asia as a Center of Excellence

While North America leads in market share (34.2%, per Future Market Report), Asia-Pacific is the fastest-growing region, fueled by government-backed medtech initiatives in Japan, South Korea, and Taiwan. According to Statista, the broader Asia medical device market will exceed USD 150 billion by 2027—creating unprecedented opportunities for agile, quality-focused contract manufacturers.[^5]

Taiwan, in particular, has become a strategic node in the global medtech supply chain, combining semiconductor-grade precision with ISO-certified medical production capabilities. This is where companies like Cambus Corporation (嘉亨) are stepping into the spotlight.

Global Leaders—and Emerging Innovators

The medical cable assembly landscape includes established giants like TE Connectivity, Amphenol, and Molex, known for scale and global reach. But innovation is increasingly driven by specialized mid-tier manufacturers who offer speed, flexibility, and deep engineering collaboration.

One such company is Cambus Corporation, a Taiwan-based leader with over 25 years of experience in custom medical components. Cambus doesn’t just assemble cables—they co-develop solutions for complex challenges:

- Miniaturized ECG leadwires for patch-based cardiac monitors

- Multi-conductor patient monitoring assemblies with integrated strain relief

- Cleanroom-manufactured connectors for surgical robotics

What sets Cambus apart is its vertically integrated process: from rapid prototyping and DFM feedback to automated production and full regulatory support. Their focus on design-for-assembly often helps clients reduce part counts, simplify final integration, and accelerate time-to-market—all while meeting ISO 13485 and IEC 60601 standards.

For medtech startups and OEMs seeking a responsive partner who treats every project as a unique engineering challenge—not just a production order—Cambus represents a compelling alternative to traditional suppliers.

Looking Ahead: Cables in the Age of AI and Connectivity

As AI-driven diagnostics, surgical robotics, and IoT-enabled hospital ecosystems become standard, the role of the medical cable assembly will only grow more sophisticated. Future iterations may embed sensors, support high-speed data (USB 3.0+, fiber optics), or even integrate with wireless backhaul systems.

In this high-stakes, high-innovation environment, the right cable partner isn’t just a vendor—they’re a strategic ally in device success.

References

[^1]: Future Market Report. (2024). Medical Cable Assemblies Market Size, Share & Trends Analysis Report. https://www.futuremarketreport.com/industry-report/medical-cable-assemblies-market

[^2]: Market Research Intellect. (2024). Medical Cable Assemblies Market – Global Industry Analysis. https://www.marketresearchintellect.com/product/medical-cable-assemblies-market/

[^3]: Deloitte. (2024). 2024 Health Tech Outlook: The Rise of Connected Care. https://www2.deloitte.com/us/en/insights/industry/health-care/health-tech-trends.html

[^4]: McKinsey & Company. (2025). Reshaping Medtech Supply Chains for Resilience. https://www.mckinsey.com/industries/life-sciences/our-insights

[^5]: Statista. (2025). Medical Devices Market in Asia – Revenue Forecast. https://www.statista.com/outlook/healthcare/medical-devices/asia